What is EMV?

EMV (Europay MasterCard® Visa®) was formed with the intent to improve the safety of payments through enhanced card security and standards. Card fraud has greatly subsided in countries that have already enforced EMV. Why? Because EMV cards provide superior security over traditional magnetic stripe cards:

- EMV cards are embedded with a micro-processing chip that generates a unique number (called a cryptogram) for each sales transaction, making it remarkably difficult to use a cloned card on a card-present transaction

- Magnetic stripe cards use static data that can easily be stolen and reused for fraud

Over the past few years we have seen massive data leaks at large traditional businesses and online retailers. Chip cards and their increased security protocols will make it nearly impossible to use illegally obtained credit card numbers.

The U.S. currently accounts for almost half of the planet’s credit card fraud1, and remains the only country in the world where counterfeit-card fraud has been consistently growing over time.

Additional benefits and advantages of EMV:

- Specification allows for both contact and contactless transactions

- Provides a common global experience for cardholders

- Enhanced card authentication protects against various types of fraud such as lost/stolen and counterfeit cards

- Supports enhanced card verification methods

- Increased security protects against unauthorized transactions

- As card-present card fraud gets increasingly difficult, criminals will begin to prey on more vulnerable targets

- Introducing the EMV standard in the U.S. will make using cards abroad easier for American travelers. In turn, international travelers will have peace of mind when conducting transactions in the U.S., creating a unified cardholder experience.

- Reduces chargebacks due to counterfeit or stolen cards, alleviating the merchants time and frustration

- Helps merchants avoid the potential liability for card-present card fraud

- The introduction of EMV chip cards in the U.S. helps pave the way for new technology and contactless transactions

Since completing its migration to EMV, Europe has seen an 80% reduction in credit card fraud.– Gemalto

What are my EMV certification options?

Preparation for the transition to EMV begins with hardware infrastructure and physical card payment processes, and the integration choices made today will have significant implications tomorrow. For some of your merchants, one primary consideration is the choice between integrated or semi-integrated payment environments. In turn, if you're a point-of-sale (POS) developer looking to enable acceptance of EMV cards, there are three main options: direct certification, moving to stand-alone terminals and an EMV out-of–scope integration.

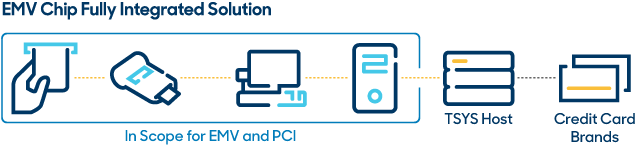

Direct EMV Certification

Generally speaking, in an integrated solution the payment application is part-and-parcel with the core POS solution; one piece of software handles every aspect of the transaction, from bar code reading to tendering and processing payments, to managing inventory and replenishment.

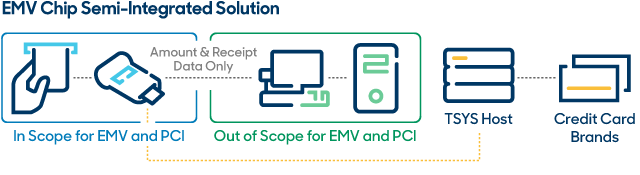

Semi-integrated EMV Certification

In a semi-integrated environment, the terminal or peripheral device used to capture credit card data is connected to the POS application, but the application used to actually process card payments is on a separate device.

Two EMV integration options to fit your need

| Direct EMV Certification | Semi-integrated EMV Certification |

|---|---|

| Enables a great degree of customization | Puts the burden of the Level 3 certification on the payment application provider |

| Offers the option to choose which device to take through certification and the flexiblity to configure terminal transaction flows | Simplifies the transaction process flow for the POS developer |

| A number of complex steps are required, which can be time intensive | Integrating to the EMV out-of-scope solution is similar to the payment integration process that POS providers are already familiar with |

| Comes with a high cost, both from development and QA resource time, as well as the purchase of the necessary test cards, kits and tools needed to complete the certifications | Speeds up your time to market, shortening the process from months to merely weeks |

| Would mean certifying each solution brought to market with each EMV entry device you choose to go to market with, to each processor you choose to work with, for each of the four card brands. If you choose to enable debit in the solution, incremental costs would be incurred for each debit network certification. | Cost effective for the POS developer because the cost of EMV device integration is taken on by the EMV out-of-scope solution provider |

| Customization of the available EMV devices is limited | |

| Comes with a limited amount of terminal screen flows |

Read the white paper, Planning for EMV: Integrated or Semi-Integrated Payment Solutions?

for a closer look into your certification options.